Despite the huge and often publicized earnings of top fund managers, the hedge fund industry works like many other. The very top performers bring in huge amounts of compensation, while most professionals earn much less. Typically hedge fund employees earn figures in the low hundreds of thousands, not millions (and surely not billions).

And what about compensation for those in hedge fund marketing? You must first understand how the typical firm is structured before tackling the compensation issue.

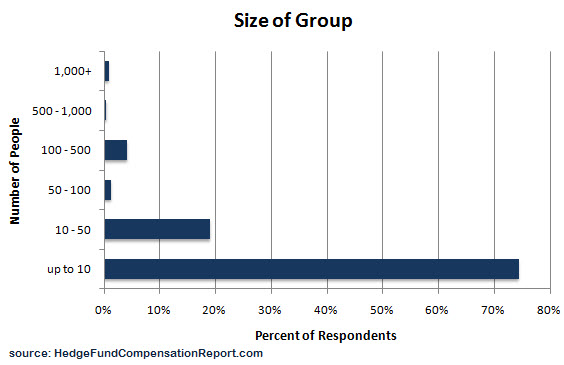

The majority of hedge fund firms are small. In fact, about three quarters of hedge fund groups have less than 10 employees. Given the small team size, most team members will play some part in marketing the fund.

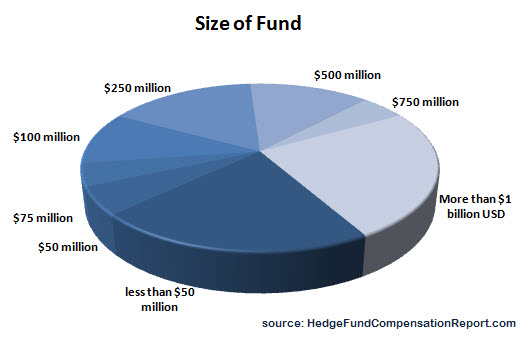

A similar finding shows that the median size of the fund is much smaller than someone from outside the industry might expect. Of course, those inside the industry already knew this to be true.

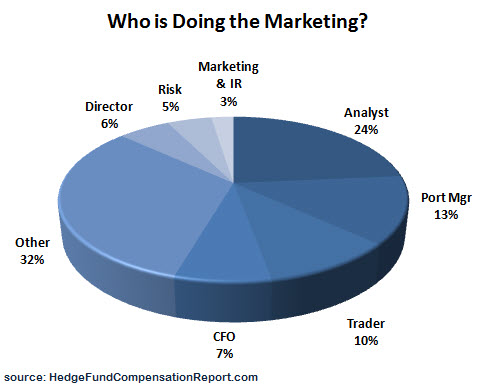

And when you examine the titles involved in marketing and investor relations, it is hard to find someone who isn’t involved.

So, when looking at compensation for hedge fund marketers, we find roles at all levels impact the averages. And it doesn’t stop at a title or specific responsibility.

There are many differentiating factors which can impact compensation at hedge funds. On a personal level, the role, experience and education of the employee will be a deciding factors. While at the fund level, the performance and size of the fund often play a large role in determining compensation.

About HedgeFundCompensationReport.com

The Hedge Fund Compensation Report gives you an inside look at the hedge fund industry in terms of compensation practices, work environment, time off and the impact of today’s markets on hedge fund pay.

The Report is based on benchmark data collected directly from those involved in the hedge fund industry. Thousands of hedge fund portfolio managers, analysts, traders, CFO’s, COO’s, risk managers and others from hedge fund firms, both large and small have contributed. Over the years firms such as Bank of New York Mellon, Barclays Global Investors, Citigroup, Fountain Advisors LLC, HSBC, Kellogg Capital Group, Lansdowne Partners, UBS, Black River, and Deutsche Bank have participated in the survey.