As the scoreboard signals the final minutes of the third quarter, mayhem breaks out on the field of play. It isn’t football, basketball, soccer or hockey; it is the equity markets.

The Play by Play

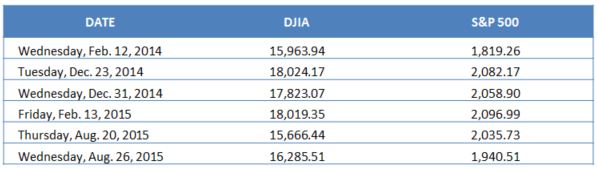

On December 23rd, 2014, the DJIA closed above 18,000 for the first time, which, coincidentally, marked the 101st anniversary of the Federal Reserve Bank’s founding. However, 2014 closed with the Dow at 17,823.07 and the eighteen-thousand threshold was not crossed again until February 13th, 2015 with a closing figure of 18,109.35.

In the period spanning February 13th, 2015 through July 20th, 2015, the NYSE closing bell rang on either side of eighteen-thousand, crossing the stripe and dropping back multiple times.

However, in the 30 days following July 20th, all of the Dow’s market closes fell below eighteen thousand.

Then, on August 20th, 2015, the DJIA plummeted in a correction that saw it close at 15,666.44. This was the first time the DJIA closed below seventeen-thousand in all of 2015, and the first incidence of the Dow closing below sixteen-thousand since February 12th, 2014. At the close of business, August 26th, 2015, the DJIA rebounded to 16,285.51 and the index continues to close below seventeen-thousand.

The S&P 500

The table below demonstrates corresponding closing values for the S&P 500:

No one is suggesting this turn of events is anything beyond a market correction and frankly, it will take a few weeks to establish this as fact. One thing however is clear. This does not signal the end of the bull market. An official end to the bull market would require the Dow to tumble to 14,681.12.

The S&P 500 has largely mirrored the fortunes of the Dow, failing, thus far, to break the 2000 plus benchmark it had achieved prior to the correction.

Keeping the Hedge Fund Managers Up at Night

The events of August 20th, and the days immediately following, have undoubtedly taken a toll on the sleep patterns of hedge fund managers, particularly those whose funds are pursuing equity strategies. Volatility in commodities, such as oil, gold and silver, will affect a large swath of hedge fund managers beyond those pursing equity strategies.

These recent developments, although dramatic and consequential, pale in comparison to the burning question of a Fed rate hike. The FOMC’s meeting is just weeks away and the signals are mixed.

Many argue that the recent market correction (if that is what it shakes out to be); uncertainty in Chinese equity markets and slowing GDP growth in Europe, China and Southeast Asia may prove to be no incentive for Fed Chair Yellen to implement an increase.

The bottom line is hedge fund managers are sailing troubled waters. Events like those seen this past two weeks will certainly separate the wheat from the chaff … can’t wait!