Starting a Hedge Fund

So, you are are a trader with a solid track record and thinking about starting a hedge fund? There are many factors to take into consideration including the time and money required in addition to hedge fund regulations.

Where will the seed capital come from? Just like any other start up that looks for angel investors or a venture capital firm to provide the start up capital, you will need to find your seed investors. Often times, that capital comes from friends and family but still requires a pitch book of some sort. Keep in mind the start up costs as well, which can easily run $50,000 USD or more.

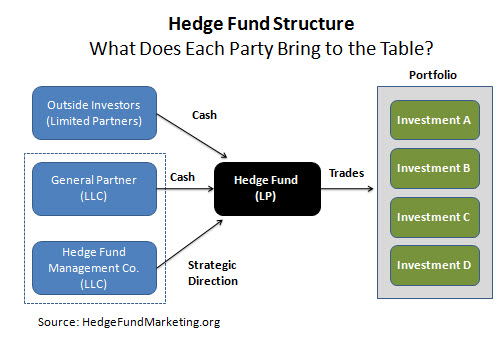

Here is a simple diagram that shows the entities typically involved in a hedge fund and what they contribute.  Documents must be prepared to establish the fund and it associated entities. The private placement memorandum is the document that potential investors spend most their time on. It is similar to what you might see from a mutual fund and describes the terms of the fund, including the most important piece – the management team.

Documents must be prepared to establish the fund and it associated entities. The private placement memorandum is the document that potential investors spend most their time on. It is similar to what you might see from a mutual fund and describes the terms of the fund, including the most important piece – the management team.

Your trading strategies may work well in your current situation but what about in your new fund? Will your assets be greater or less than what you are trading today? Sometime the size of the fund dictates some flexibility in your investment strategy.

Then, of course, there are the hedge fund regulations you must follow. Although hedge funds don’t have the same reporting requirements as some other publicly available investments, the registration requirements are strict and must be followed. For this reason, you will need a well-versed hedge fund attorney.

Speaking of service providers, you will need more than just a hedge fund attorney. Hedge funds require administrators, accountants, a prime broker (to provide a central clearing house for trades and maybe even capital introductions) and possibly a third party marketer as well. These advisers are well worth the investment as they ensure the fund starts off on the right foot, raises the necessary capital and follows the regulations.

There is as much due diligence in the process of starting a hedge fund as there is in building your portfolio. Knowing what to look and doing your research is the key to success.

Subscribe to Hedge Fund Marketing updates

Get our best hedge fund marketing content and latest posts delivered to your inbox.

Enter your email address below: