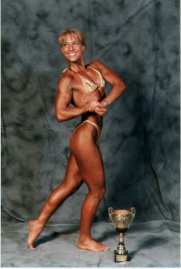

To say that Sonia Schulenburg is an overachiever is a bit of an understatement. Educated in Mexico City, she moved to Edinburgh, Scotland, where she competed as a bodybuilder while earning her doctorate degree in artificial intelligence. Now she’s starting a new hedge fund based on a computer-driven model that aims to instantly adapt to changing market conditions.

Photo by Alan Holmes/A.N.B.

Called Level E Capital, her fund has attracted $40 million from investors so far, according to an article in Businessweek. “This is definitely different because it’s dynamic,” says Michael MacPhee, partner at Baillie Gifford, an independent investment firm based in Edinburgh with £74 billion (US$119 billion) in assets. Ballie Gifford has invested $15 million in the new fund so far. “This thing actually adapts, it’s intelligent,” says MacPhee.

Schulenburg’s Maya Fund makes up to 1,000 trades a day, focusing on the FTSE 100 and Standard & Poor’s 500-stock indexes. It can buy long or short, and uses artificial intelligence to change its buy and sell criteria as it digests new market data.

Because it can alter its trading decisions so quickly, the fund’s investments tend to have less volatility. It may not capture the full upswing of a bull market move, but then it won’t fall as much during a selloff, either. The result is more steady gains. The fund has risen 5.3% year to date, compared to the 2.9% increase of the FTSE.

“It gives a reasonably consistent return on a liquid portfolio, and it will compare well with other safer investments such as bonds or cash,” says Colin McLean, CEO of SVM Asset Management in Edinburgh, who is reportedly thinking about investing in the Maya Fund.

Interestingly, Schulenburg hasn’t patented her new approach because that would force her to divulge how it works, making it easy for competitors to copy. In the meantime, she hopes to raise at least $1 billion from investors over the next five years, and thinks the fund’s low volatility is a big selling point.