When most people talk about hedge fund compensation, the conversation turns to the top paid hedge fund managers such as George Soros, David Tepper or John Paulson. This is understandable, of course. How can we ignore that, in the worst U.S. economy in decades, top hedge fund managers earned over $25 billion in compensation?

How much marketing do these top dogs possibly need to do these days? Their results speak for themselves and, even in 2010, investors are still seeking out managers like these.

But what about the typical hedge fund? Marketing and investor relations have never been more important activities.

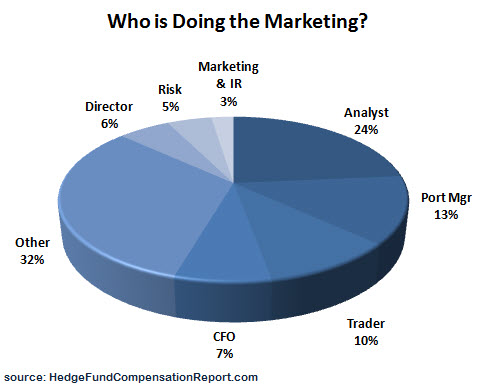

Who is Doing Hedge Fund Marketing within the Firm?

Take a look at who is doing marketing and IR within the firm and you’ll see it is hard to find someone who isn’t involved.

Are Traders, CFO’s, Risk Managers really doing marketing? Absolutely.

With the median hedge fund group size of less than 10 people, everybody plays a part. And the activities shift along with the size of the fund.

In the early going, the focus is on raising money. In later stages, much of that energy moves to investor relations. And, in recent years, the proportion of energy spent on investor relations has increased with the pressures for increased transparency.

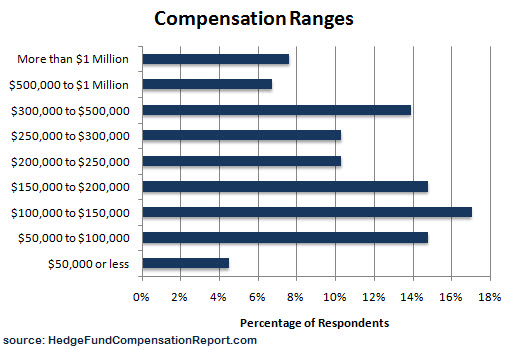

And What Do They Get Paid?

There are many factors that impact hedge fund compensation. With firm team members wearing so many hats, you will find big ranges of earnings which makes it difficult to define a hedge fund compensation standard that fits across all stages of the fund.

Traditionally, there are three main factors in determining hedge fund compensation: experience, performance of the fund and size of the fund. The bigger the fund, however, does not necessarily mean the higher compensation.

And for a new fund, the manager doesn’t have the luxury of a generous pay package. In fact, he might not get any compensation at all for some period of time (thus the lower end of the range in the graph above).

About HedgeFundCompensationReport.com

The Hedge Fund Compensation Report gives you an inside look at the hedge fund industry in terms of pay practices, work environment, benefits and the impact of the markets on hedge fund compensation.

Annually, the Report is based on data collected directly from those in the hedge fund industry. Thousands of hedge fund portfolio managers, analysts, traders, CFO’s, COO’s, risk managers and others have participated in the studies. Over the years firms such as Bank of New York Mellon, Barclays Global Investors, HSBC, Kellogg Capital Group, Lansdowne Partners, UBS, Black River, Deutsche Bank, and Citigroup have participated in the survey.