The volume of recently published hyperbole regarding hedge fund asset flows might lead one to believe that the demise of the hedge fund industry is imminent.

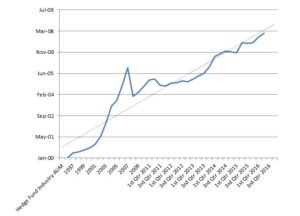

However, the chart below suggests just the opposite. It reveals a positive trend line with respect to the growth of assets under management (AUM). More importantly, the chart reveals that current outflows are not unique. Predictably, hedge fund AUM plummeted in the immediate aftermath of the financial crisis in 2008, but post crisis, the trend is clearly positive.

While there have been stutter-steps, particularly in 2011 and 2014, during which outflows exceeded current levels, these stutter-steps garnered few headlines.

Why Are These Outflows Receiving So Much Attention Now?

Two factors come to mind. First, past outflows, apart from those attributable to the financial crisis, were generic in nature—generic in the sense that the outflows could not be linked, in any credible way, to specific investors or groups of investors. In other words, the pullback was a broad one.

In contrast, financial journalists have been successful in tying the current spate of outflows to specific entities. These include public pension funds and high profile insurance companies, the likes of AIG and MetLife. Although this makes the read more interesting, one has to wonder if the direction of hedge fund industry AUM is being accurately portrayed?

Secondly, financial journalists have enjoyed some success in correlating these outflows with the so-called exorbitant hedge fund fees, a favorite target of those in media circles.

No one will ever interview an investor that has a positive take on hedge fund fees. No investor enjoys paying fees of any kind. For this reason, the fact that investors continue to opt for hedge fund investment speaks volumes. Clearly, these investors are willing to pay for results.

So…No Worries?

Hardly! Average hedge fund performance is mediocre at best. As one might expect, hedge fund outflows can be traced to those firms posting losses in 2015. Outflows have expanded to include funds with negative gains thus far in 2016. According to eVestment, hedge fund firms reporting the most significant outflows have returned an average of around negative four percent, year-to-date. These same firms averaged 2016 losses exceeding five percent through their first quarter.

The hedge fund industry and the auto industry may have much in common. How many recall such automotive nameplates as Nash, Hudson, Crosley, Kaiser, Packard or Studebaker? These companies, vibrant in the 1950’s, have disappeared. Why? They were outperformed.

Hedge fund firms are not exempt from market forces. Those firms with an excellent track record of performance will excel. Those who fail to generate gains for their investors will fail. There are around 11,000 hedge fund firms. Does anyone believe that an investment genius sits at the helm of each of these firms? Of course not!

Just as the number of auto manufacturing firms declined in the decades following 1950, the number of hedge fund firms will decline as well. However, assets under management will almost certainly continue to rise, but concentrated in fewer firms with a proven record of success.

Along the way, AUM will see some fits and starts (as we are seeing now) but, as the chart demonstrates, the momentum will be upward.