Recent reports show that hedge fund assets have risen to an estimated $2.25 trillion in 2012. Add to this unprecedented growth in the demand for compliance and support staff created by Dodd-Frank, and the elimination of the general solicitation ban mandated by the JOBS Act, and you have a very promising outlook for job opportunities in hedge funds and private equity firms.

Mixed Messages

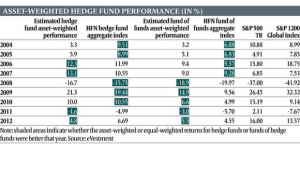

Hedge funds have shown respectable year-over-year gains, but performance has plummeted with respect to equity benchmarks like the S&P 500, which gained around 13.5 percent in 2012. Hedge fund gains have lagged well behind benchmark equities as this graphic from Hedge Funds Review illustrates, with the hedge fund aggregate index reflecting a 6.69 percent rise at the close of 2012.

Institutional investors, perhaps the single most significant contributors to a fund’s assets under management, express growing disappointment in their hedge fund returns. In fact, of 85 institutional investors surveyed, 35 said the fund failed to meet their expectations.

Institutional investors, perhaps the single most significant contributors to a fund’s assets under management, express growing disappointment in their hedge fund returns. In fact, of 85 institutional investors surveyed, 35 said the fund failed to meet their expectations.

How Will This Affect Jobs in Hedge Funds?

Consensus opinion is that hedge funds will continue to attract investors, with most experts suggesting assets under management will show around 2 percent growth in 2013. That means roughly $40 to $50 billion dollars in new money. Some are even suggesting that the aggregate value of assets under management may top $3 trillion by the end of 2013.

While growth in assets under management does not necessarily trigger the need for additional staff, changing investment strategies can open doors for those with experience in these new strategies.

According to a report published by Deloitte’s Center for Financial Services, hedge fund managers seem likely to pivot, turning to investment diversification strategies requiring expertise they may not have available in-house. This has the potential of triggering employment opportunities in hedge fund and private equity for those possessing the right skill set and experience. Examples might include Undertakings for Collective Investment in Transferable Securities (UCITS), emerging markets, frontier markets, European credit, real estate and distressed debt. Others may choose to pursue niche strategies like structured credit or similar illiquid fixed income instruments. Also, consideration needs to given to the probability of hedge funds increasing their emphasis on long/short and other strategies in the equity market, resulting in the need for additional execution traders, equity analysts and portfolio managers.

Best of the Best

Make no mistake, hedge funds are struggling to control costs and combat downward pressures on fees. As a result, applicants will be under the microscope. Hiring managers want applicants who can add value to the firm beyond the applicant’s core competency.

Shifting Paradigm

The hiring paradigm for private equity and hedge fund jobs is shifting in the wake of hedge funds’ lackluster 2012 performance versus equity indices. Entry level and junior positions are no longer going to be filled by applicants fresh out of business school. Rather, the emphasis will be on hiring seasoned staffers, with several years of work experience, that are capable of demonstrating an outstanding track record.