Having suffered five straight months of net outflows, the hedge fund industry turned a corner in February and posted net inflows of $7.9 billion, a number sufficiently robust to overcome January’s net outflows of $5.2 billion and put the industry in black ink for 2017.

This happy news was accompanied by another heartening statistic—hedge fund assets under management (AUM) have reached $3.085 trillion, eclipsing the July 2015 high water mark.

Before We Begin Patting One Another on the Back

While this is welcome news, it is not indicative of a sea of change in the industry. A $2.7 billion increase in AUM averages to a paltry $1.35 billion per month, an infinitesimal growth rate in a $3 trillion dollar enterprise. The fact is, very little ground was gained and, to be completely objective, very little ground had been lost. A swing of under $30 billion, in either direction, represents a swing of less than one percent.

While black ink is preferable to red ink, no one should be exaggerating the magnitude of this news. By any definition, the industry is at a comparative standstill in terms of growth.

History Proves This to Be True

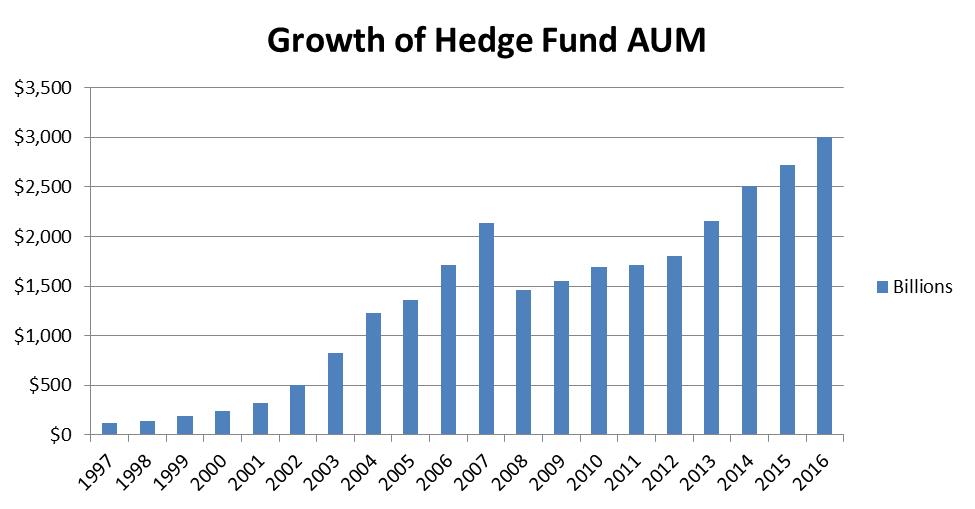

As the chart shows, hedge fund AUM doubled in the four years from 1997 through 2000, growing from $118 billion in 1997 to $237 billion in 2000. From 2000 to 2004, hedge fund AUM ballooned to $1.3 trillion, a more than fivefold increase. From 2004 to 2007, hedge fund AUM came very near to doubling again reaching $2.14 trillion.

By the end of 2008, hedge fund AUM had contracted by almost 32 percent, falling to about $1.458 trillion, a figure just $97 billion greater than total AUM in 2005. It would be the end of 2013 before hedge funds returned to pre-financial crisis levels of AUM. In short, the financial crisis wiped out six years of AUM growth.

The Way Back

The years that followed 2013, hedge fund AUM increased 16 percent in 2014, 9 percent in 2015, and 10.5 percent in 2016. The current consensus, as expressed by respondents to the Credit Suisse Hedge Fund Investor Survey cites an “optimistic growth forecast of 3.5% for net inflows for the hedge fund industry this year.”

There is nothing “optimistic” about this forecast. Growth in the 3 to 4 percent range would be the lowest recorded in the past three years. Robust industry growth is only possible by claiming an increased share of the capital controlled by institutional investors. The clearest path to achieving this is through improved performance and, to a lesser extent, fee flexibility, coupled with the broader implementation of hurdle rates.

Final Thoughts

The hedge fund industry remains at the crossroads. While it is a positive to learn that hedge fund AUM has reached an all time high, one must guard against any creeping complacency. History tells that these are not the best of times for the hedge fund industry and the industry needs to govern itself accordingly.

Interesting read. 2016 saw an increase of 3% into alternative asset investing which is an area of continual growth for return focused, tax savvy high-net-worth individuals looking for real yield. Classic & Collectable Cars for instance have outperformed both conventional and alternative assets by a meaningful margin, and unlike wine the asset class can be enjoyed without any detrimental value destruction. According to Knight Frank, Classic and Collectable Cars have risen 496% in the last 10 years and to top it off, it’s a Captial Gains Tax exempt asset class too.